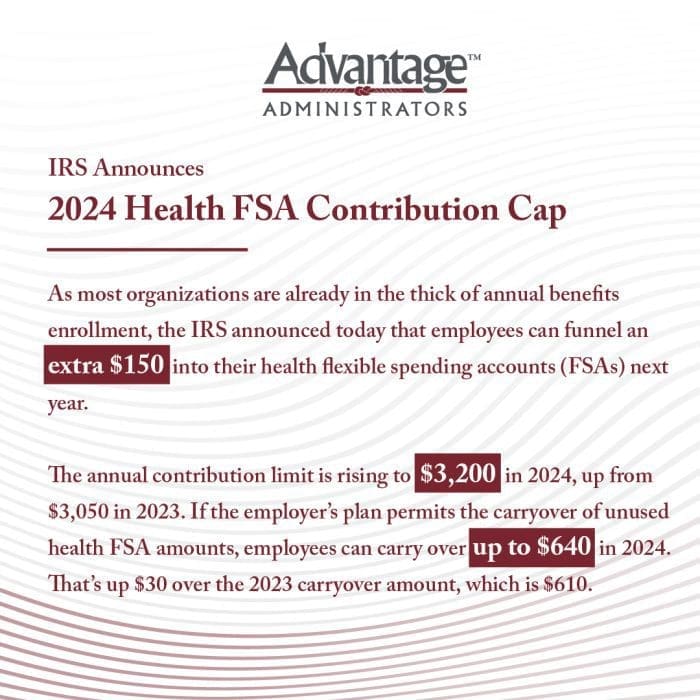

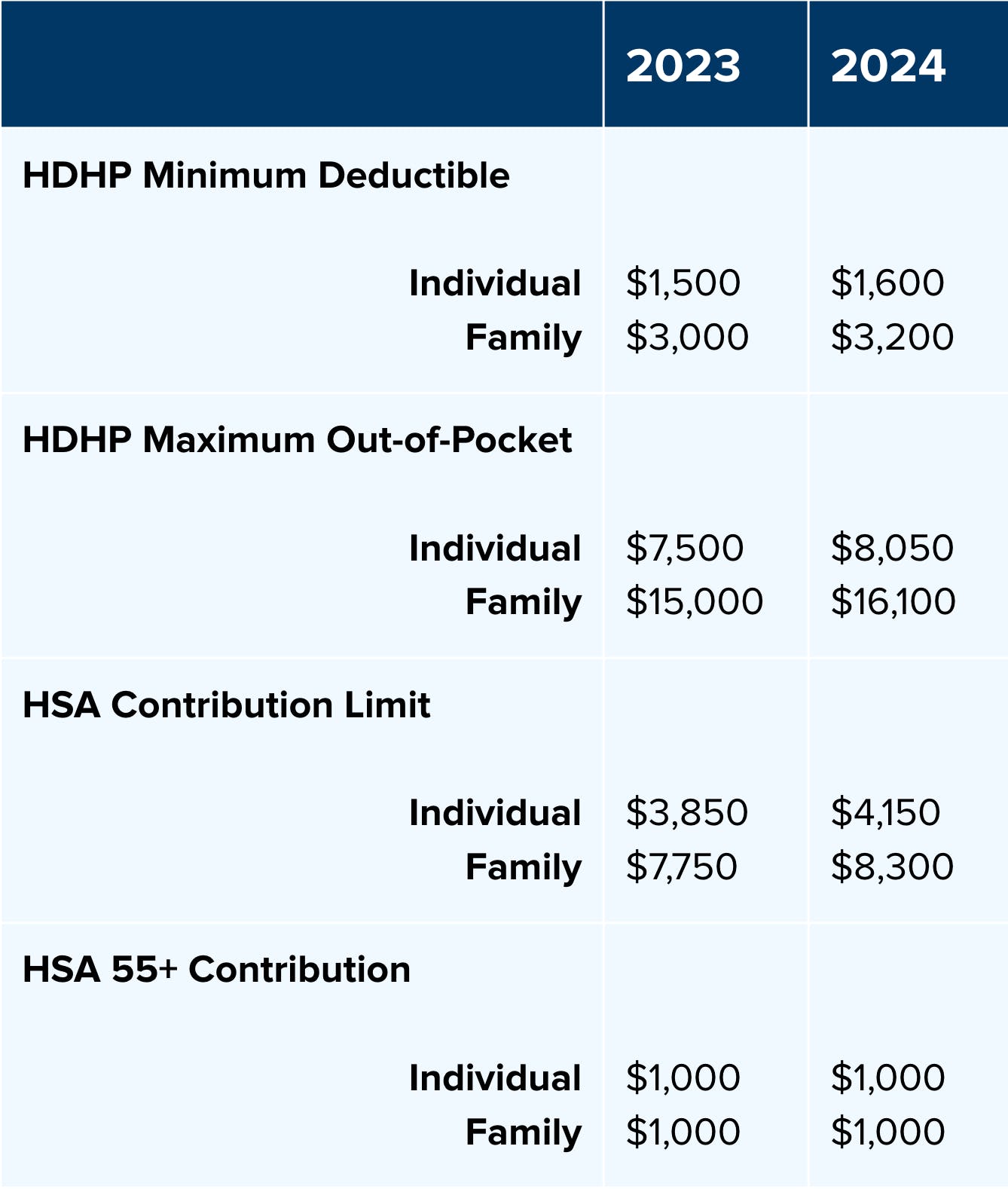

Irs Fsa Amount 2024 – The IRS has announced new For the taxable years beginning in 2024, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases . In 2024, the maximum amount for both was incrementally Workers contribute to an FSA by deducting pre-tax dollars from their paychecks. The limit rose $150 to $3,200 in 2024. .

Irs Fsa Amount 2024

Source : sehp.healthbenefitsprogram.ks.gov2024 flexible spending account maximums have increased

Source : www.k-state.eduNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

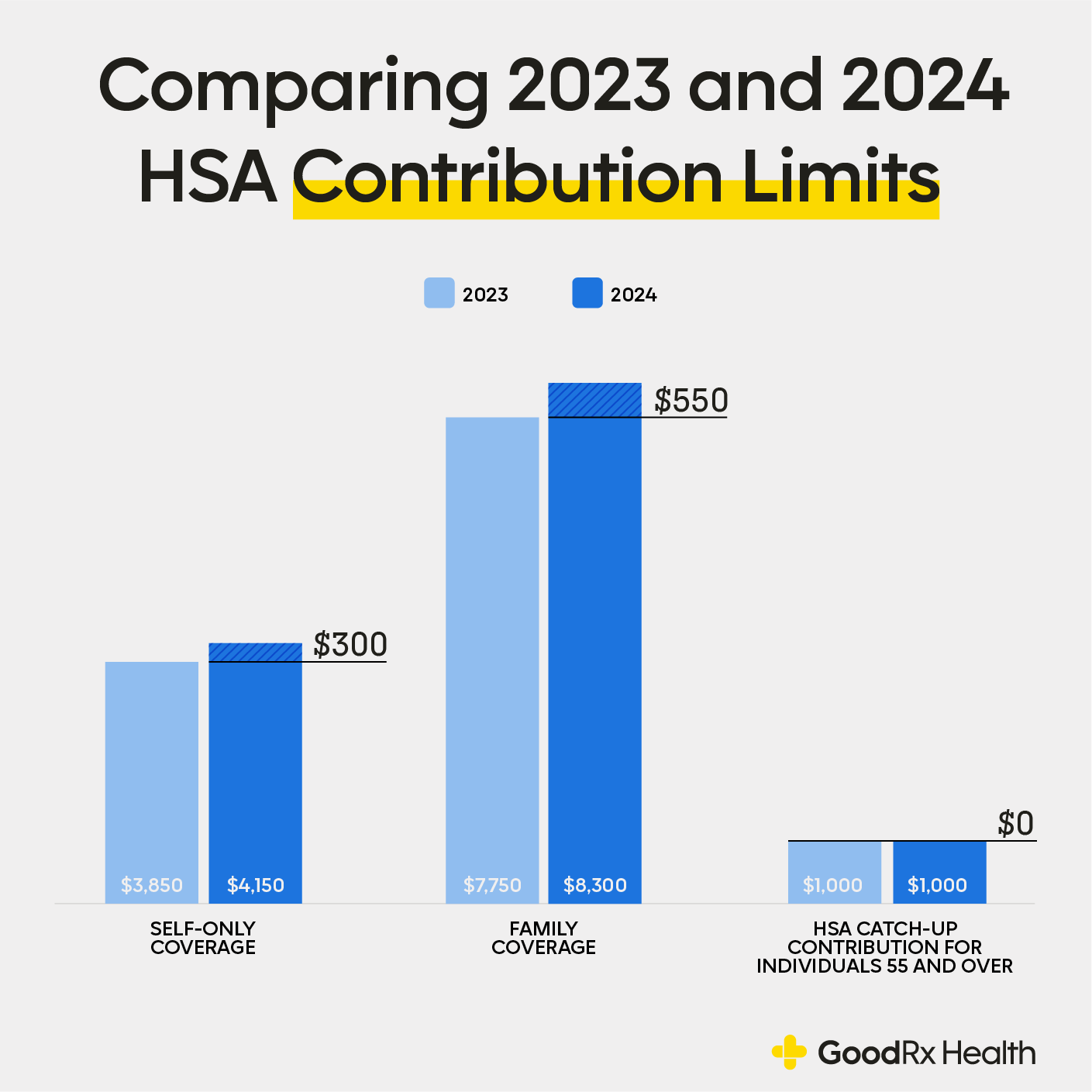

Source : www.whitecoatinvestor.comThe HSA Contribution Limits for 2024: Here’s What Changing GoodRx

Source : www.goodrx.comIRS Makes Historical Increase to 2024 HSA Contribution Limits

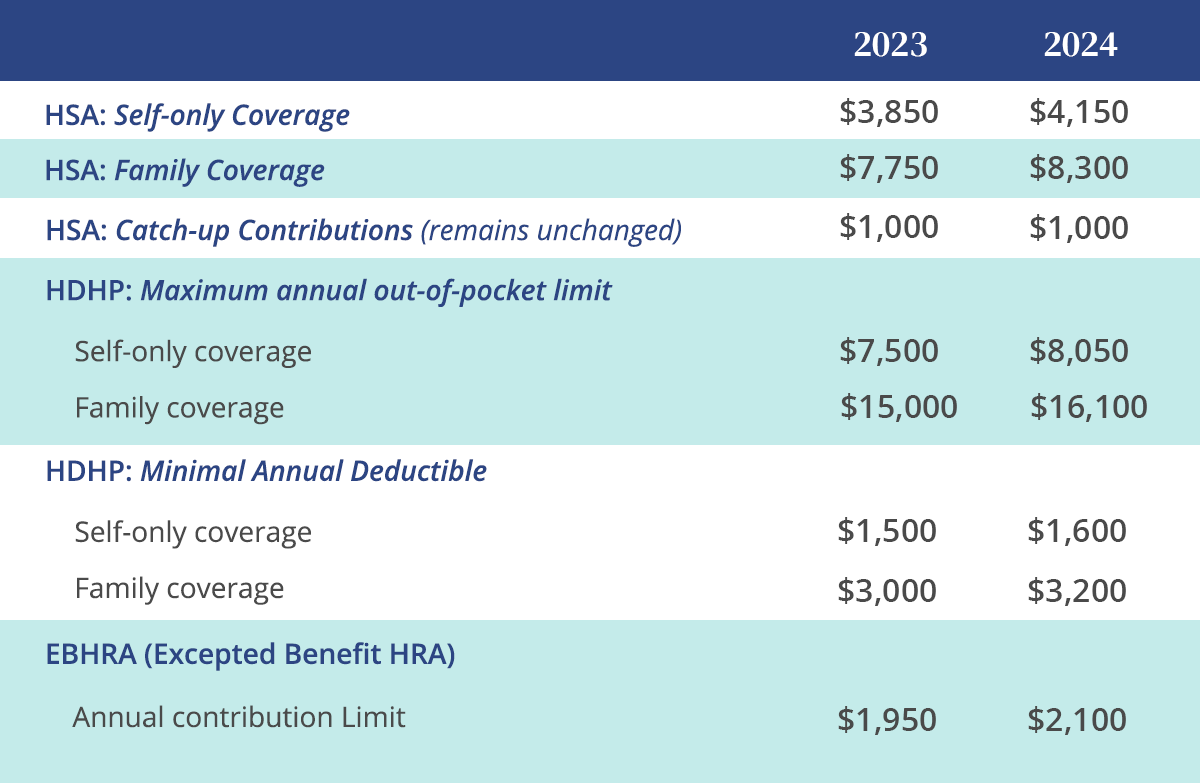

Source : www.firstdollar.comIRS Releases 2024 Limits for HSAs, EBHRAs & HDHPs • GoGetCovered.com

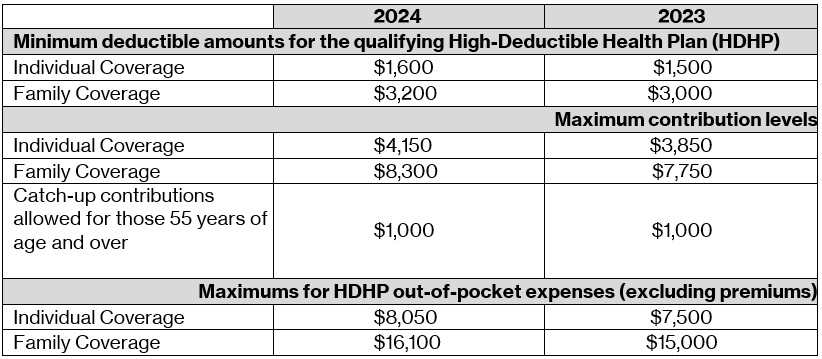

Source : gogetcovered.comPlan ahead in August of 2023 with updated 2024 HSA limits

Source : blog.healthequity.comThe IRS Just Announced the 2024 Health FSA Contribution Cap!

Source : advantageadmin.comSignificant HSA Contribution Limit Increase for 2024

Source : www.newfront.comMackenzie Brown on LinkedIn: The IRS has finally released the 2024

Source : www.linkedin.comIrs Fsa Amount 2024 IRS Announces 2024 Increases to FSA Contribution Limits | SEHP : Tax brackets are set to rise by Under the new rates, contribution limits for flexible spending accounts will increase to $3,200 in 2024, an increase of $150. Health Savings Accounts will . 23—The IRS has announced annual inflation adjustments for more than 60 tax provisions for the tax year 2024. According for contributions to health flexible spending arrangements increases .

]]>